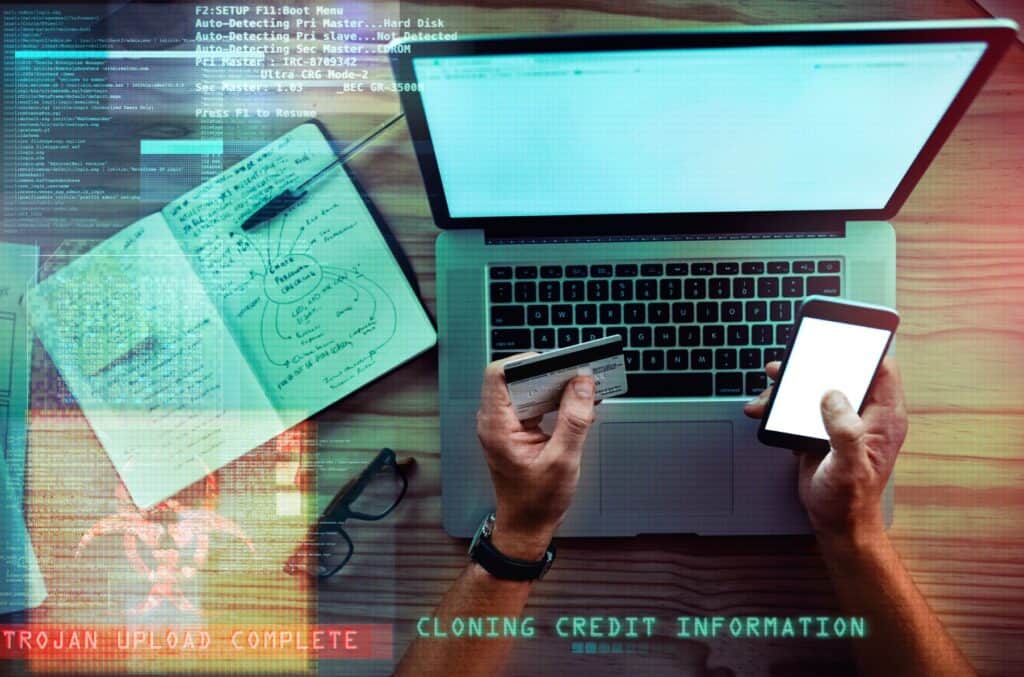

Guns and masks are old-school. Bank theft has evolved.

Fraud is as old as banks, and thanks to online banking it occurs in different forms. With the advancement in technology, the banking sector's capacity to spot anomalies must also evolve. Financial organizations need to constantly stay on top of their game in fighting banking fraud. As a business owner, you need to employ business fraud prevention techniques to ensure you don't get caught out.

While It's challenging to catch fraud considering the countless new methods criminals use to defraud businesses.

Generally, financial experts advise businesses to cross-check for fraud in their financial transactions, locations, tools utilized, launched sessions, and authentication procedures. Although, these suggestions are simpler to make than to implement.

In this article, we'll explore banking fraud and the golden rules that help businesses with fraud prevention.

What Is banking fraud

Banking fraud is a deceptive means of collecting money or other valuables from banks or any financial institutions. While bank robberies include alms, fraud operates with trickery and deceptive tactics.

Any planned activity that defrauds a financial institution is generally considered bank fraud. When people try to steal funds from any financial institution whether online or offline, they commit banking fraud.

Another method is providing a bank with fake information to get financial assets is illegal. It includes deliberately defrauding a financial institution to get assets, cash, securities, loans, or properties by providing false information or acting under pretences. Banking fraud is a white-collar offense charged at the federal level with severe consequences.

Importance of fraud detection for banking

Fraud detection for businesses and banking is crucial to help identify and prevent fraudsters from trying to obtain money or other financial assets. With the steady increase in banking fraud, most institutions use fraud detection and prevention techniques to protect their organization. The sole aim of these strategies is to reduce the number of fraudulent transactions on various platforms and protect customers' finances.

Improving risk awareness, accountability, and transparency in the banking sector and other financial institutions is primary in fraud detection. It enables businesses to enforce the standards that shield them from fraud. Plus, it helps them to recognize fraud as soon as it occurs, allowing them to effectively manage fraud. Several Fraud detections and prevention programs provide easy guides on fraud prevention.

Business Fraud Prevention; Ways to detect transaction fraud

Scammers adopt several strategies for performing transaction fraud. Hence, to detect transaction fraud, you must stay alert and watch out for suspicious activities.

Here are some examples of suspicious transactions to watch out for:

- Mismatched Addresses: Compare the shipping address to the billing address.

- Unusual Orders: Watch out for purchases that are ordered too quickly and seem automated.

- Rush Shipping: When a customer demands immediate shipping of their buy, it's often a case of fraud.

Learn more ways to detect transaction fraud and reduce your chance of falling prey to scammers and their gimmicks.

Five rules to prevent banking fraud

Fraud is expensive, time-consuming, and harms businesses and financial institutions in many ways. Even the best businesses are not spared from the scars of cybercriminals' attacks. Hence, quality fraud detection and prevention systems are a must-have to help safeguard your business and earn the trust of your customers.

Embracing these five “Golden Rules” will help you prevent fraud and make your business inaccessible to fraudsters:

- Embrace artificial intelligence like never before

Choose a bank which embraces AI. Due to the countless customers and transactions, banks deal with daily, it's challenging and almost impossible to track all of their transactions via human means. Human-enabled trackers will only end up creating more problems for financial institutions. It'll also defeat the essence of adopting online banking and easy transactions by complicating the online banking process. Also, more fraudsters will continue to go scot-free. However, this isn't the case with AI. Utilizing an automated system will easily detect and halt any fraud-like actions and save banks from criminals who aim to illegally earn passive income.

- Ensure your website complies with cookie laws

Cookies are chunks of data files set to gather information on your website. Cookies help to keep transactions secure and curb fraud while users run online transactions.

However, cookie laws demand consent before accessing or collecting data from your website visitors.

Aim to Include cookie consent that informs users of how you use their data. The cookie consent should include an option where users will read the privacy policy. It also needs to have options for restricting or rejecting cookies.

- Tighten your security with biometric data

Make your customers enter a set of secret characters before they access your payment portal as an excellent start. At the least, every customer must create an account and password. Businesses could even ensure that these customers set up their accounts with strong passwords before they can start to use online services. Could this get better? Absolutely! Providing a way for customers to add their biometric data adds another layer to an already-existing security protocol.

Trained hackers will crack any set of secret characters, no matter how complex those characters are designed. However, it's a different case when it moves toward having to fake a person's voice. A more reliable method to combat banking fraud is to utilize biometric capturing.

- Carry out regular auditing and checkups

You need continuous auditing and monitoring to evaluate and confirm the effectiveness of your business and your bank's control systems in authoring transactions. Put up routine, and periodic inspections to help you spot oddities. This will boost your organization's fraud detection strategies.

After the audit, enlighten your staff and business partners about the program. Publicity is particularly helpful in preventing fraud within a company. Employees will avoid engaging in fraudulent activities when they are aware of the preventative measures.

- Encourage whistleblowing

Although Suspicious Activity Reporting (SAR) may seem unusual, it isn't. People engaged in unlawful financial activities, such as money laundering, funding for terrorism, etc., will be forced to pause when they notice security that will blow a whistle on them. Whistleblowers have repeatedly benefited financial institutions in the past in battling financial crimes. It's smart for banks to develop a program that supports and upholds whistleblowing as a security measure.

- Always keep customers enlightened

When people are well-informed about fraud, they won't fall prey to it. When people are unaware, they will fall victim to these crooks and allow them to get away with their crimes. Thus, businesses must inform their clients of the possibilities and dangers of fraud and what the business is doing to avoid it.

Spreading awareness from time to time will reduce fraudulent acts like ATOs, Wire Transfers, and related frauds. Publishing press releases is the best approach to ensure that no one is left out.

Types of banking fraud

Banking fraud exists in different forms. As the days go by, fraudsters are developing new and innovative means of milking financial institutions dry. Some of these means of defrauding their victims may seem crude. But make no mistake—these criminal acts are as effective as hell!

Let's examine the most common bank account fraud in no particular sequential order.

Account takeover fraud

When a cybercriminal obtains access to the victim's account details to steal money or data, this is known as account takeover fraud (ATO). Fraudsters use various methods, including phishing, malware, and man-in-the-middle assaults, among others, to get access to a financial bank account to seize control of it. With the financial losses and associated mitigation efforts, ATO is a significant danger to banking institutions and their clients.

The majority of account takeover methods involve automated scripts that could contain hundreds of user accounts and credentials. In darknet markets, a successful attack could bring in millions of dollars in profit.

Wire transfer fraud

When a con artist asks for an instant wire transfer of money under the guise of a reliable source—typically a business partner, relative, or vendor—they are committing wire fraud. The fraudster would frequently emphasize the pressing need for the money and often claim that there was an emergency to sway the victims emotionally. The victim quickly learns that they didn't send money to a legitimate company or individual and will have to deal with the loss since they won't get their money back.

In 2021, $482 million in lost revenue due to fraud was attributable to wire transfers.

Loan fraud

A criminal fraudulently receives a loan with fake or stolen personal information. It's an act called “loan fraud.”

The fraudster will, for instance, open a mortgage in your name (or obtain a mortgage loan) and leave you to pay it off.

Scammers collect personal information in several ways. They can use phishing scams to get personally identifiable information (PII). Or they will persuade you to install software that gives them access to your device. However, given the frequency of data leaks in recent years, getting your account information on the Dark Web is the most straightforward alternative.

To avoid this, you need to ensure that 3rd party services you use in your website and business, like payment processors, are secure and robust in maintaining peoples information confidentially.

Actively protect your organization from banking fraud

Every business and financial institution must ensure they set a premium solution to detect and prevent fraud. Implementing a decent fraud detection system will lessen the likelihood of fraud within your organization. Also, prompt fraud identification allows banks to avoid potential losses.

To reduce the possibilities of banking fraud, we've provided some effective business account fraud prevention methods. With an excellent fraud detection and prevention program, you are sure to protect your organization from fraudsters.