Are you a real estate professional interested in learning more about mortgage marketing? Or maybe you’re just curious to understand how the industry operates. Whatever your reasons, get ready to learn—here are the top 6 facts you should know about mortgage marketing.

Mortgage sales can be an exciting and rewarding part of any real estate professional’s career path, however, it is important for both those new to the industry as well as experienced veterans to stay informed on all the current trends and regulations that surround this field.

In this blog post, we will discuss everything from digital lead sources, what methods work best for capturing prospects’ attention online, how technology has opened up new ways to market mortgages both online and offline, as well as offer advice on ensuring your business is compliant with applicable laws.

Read on to learn more about how successful mortgage marketers are adapting their strategies around today’s ever-changing market!

What Is Mortgage Marketing and Why Does It Matter for Homeownership

Mortgage marketing is a crucial component of home ownership. It serves as a guide for loan officers to evaluate prospective borrowers and provide them with the necessary guidance and assistance needed to complete their purchase or refinance.

Whether you’re buying a first home, an investment property, or refinancing an existing loan, the marketing process can seem daunting, but having some basic knowledge of it can help make the process easier. Knowing the top six facts about mortgage marketing is an excellent way to get acquainted with this crucial part of homeownership.

Mortgage marketing encompasses a variety of different aspects such as understanding which products fit buyer needs, forming relationships with third-party professionals/providers, educating consumers on loan options, providing cost estimates for services/fees associated with loans, and staying up-to-date on market trends in order to continuously expand your pool of clients.

As such, it’s important that prospective homeowners are aware of these requirements to ensure they have access to the right resources when taking that important step toward obtaining a home loan that best meets their financial goals.

How to Create a Winning Mortgage Marketing Plan

A successful mortgage marketing plan needs to be tailored to your target audience in order to capture their attention and generate leads. The key to creating a winning plan involves understanding the top 6 facts about mortgage marketing. Knowing these fundamentals will give you an edge when putting together a memorable, effective campaign—whether it’s digital, print, radio, or television. Taking time understand consumer wants and needs are essential and using the right mix of branding tactics means taking advantage of all available opportunities and channels that are out there.

With research and planning comes a deep understanding of your target market, their preferences, and what will ultimately lead them to commit to a loan with your organization. Utilizing online and offline methods such as direct mail, email campaigns, social media advertising, search engine optimization (SEO), pay-per-click (PPC) advertising, and other strategies can help you reach your audience in a meaningful way. All of this information can then be used in developing a customized strategy that will ensure success in taking your business to the next level.

Establishing Goals, Objectives, and Strategies

Mortgage marketing is a daunting task, but it doesn’t have to be. One of the most important elements in any successful digital mortgage marketing strategy is having clear, achievable goals. After all, how can you expect to make progress without setting a destination? Once established, these goals should map to strategic objectives that are measurable and time-sensitive. Establishing precise strategies in line with each objective is even more critical to its success. Knowing the six facts about mortgage marketing before setting out will ensure the right tactical approach is taken and ultimately help build trust with borrowers and resonates with their needs.

Investing time upfront in creating clear goals, objectives, and strategies will result in providing strong foundations for any mortgage marketer on their journey ahead. Overall, understanding the six facts about mortgage marketing is a critical step to achieving success. Being well-informed on this topic will help provide clarity in creating winning plans and strategies that attract borrowers and result in more closed loans. Having a good grasp of these fundamentals will ensure you have the expertise necessary to be successful in today’s competitive mortgage market.

Tips for Connecting with Prospective Homebuyers

For mortgage providers looking to reach prospective homebuyers, understanding the market can be a huge undertaking. Knowing key facts about mortgage marketing can set you up for success and make connecting with buyers easier. Here are some tips for connecting with potential buyers: first, establish trust by staying digitally connected in order to advertise your services in an authentic way. Second, strategize your message carefully in order to create content that speaks directly to your prospective homebuyers’ needs.

Thirdly, consider the total experience of services from the perspective of the buyer—from researching loan options to processing paperwork quickly. Fourth, use data insights to fuel decisions on messaging and distribution channels. Fifth, leverage social platforms and attract attention with amazing visuals or stories that capture your audience’s imagination. Finally, implement a robust follow-up strategy so you don’t miss important opportunities along the journey. With these tips in mind, mortgage providers will find it easier than ever to reach their desired market and attract new customers quickly!

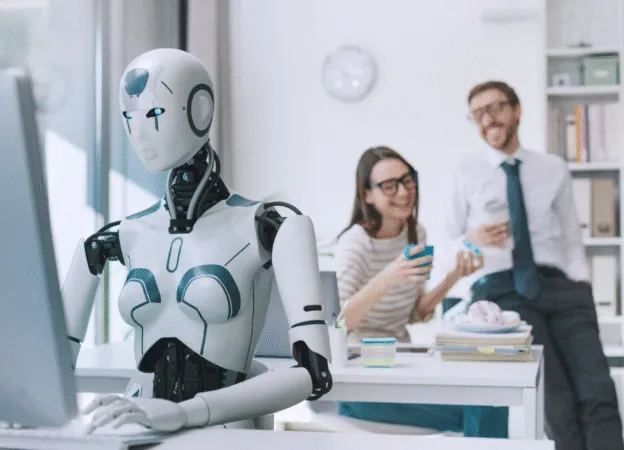

Leveraging Technology and Social Media in Mortgage Marketing

Leveraging technology and social media in mortgage marketing can help you stay on the cutting edge of digital communication and connect with potential clients in an interactive way. Mortgage professionals who use current tools to communicate their services will get noticed faster than those who rely solely on traditional methods. A modern digital strategy that includes video marketing, email campaigns, content-based social media management, and other innovations can provide substantial ROI as it relates to increasing customer engagement and visibility in the marketplace.

Plus, well-crafted campaigns designed with effective targeting algorithms can ensure that you’re strategically connecting with qualified leads while driving bottom-line results. Making sure your mortgage business has a comprehensive digital plan is just one of the six facts you should know about successful mortgage marketing initiatives. Creating and executing a successful mortgage marketing plan will ensure that you have the best chance of success when it comes to attracting new customers.

It’s important to be strategic in your planning by mapping out goals, objectives, and strategies while also leveraging technology and social media platforms to amplify your message. Additionally, making sure that your content is crafted to target the right audience and resonates with their needs will help build trust and ultimately result in more closed loans. Understanding these six facts about mortgage marketing initiatives can help you achieve success in today’s competitive mortgage market.

Analyzing Your Results and Measuring Success

When it comes to marketing mortgages, analyzing your results and measuring success is key to continuing a successful operation. To ensure that your mortgage marketing efforts are paying off, it’s essential to adopt an analytical mindset when considering different campaigns. Start by tracking the performance of your campaigns over time to get an overall idea of their effectiveness and analyze what worked and what didn’t. You may also want to factor in customer sentiment based on feedback or surveys for a clearer picture.

Additionally, understanding who is interested in applying for mortgages enables you to create targeted content and identify areas where leads may come from. Taking data-driven decisions will bring tangible results in the form of stronger metrics and improved business outcomes. With careful analysis and understanding of the results, you’ll be able to make adjustments as needed to further increase your chance of success. Ultimately, tracking performance and analyzing data gathered from mortgage marketing campaigns will help ensure that any initiatives taken have the desired outcome.

By taking a strategic approach and leveraging modern technologies, mortgage providers can create an effective strategy for reaching the right people and getting their message out. Investing in data-driven campaigns and taking advantage of social media channels are just some of the ways you can ensure that your mortgage marketing efforts have a greater impact. Additionally, understanding customer sentiment and analyzing your results over time will help you measure success while making necessary adjustments as needed. With these tips, you’ll be well on your way to making your mortgage business more successful.

In conclusion, mortgage marketing is an essential tool for lenders and other professionals who wish to promote home ownership and increase their customer base. With a carefully executed plan that incorporates strategic goals, objectives, and strategies, mortgage marketers can connect with prospective homebuyers and leverage technology and social media to grow their reach. Prioritizing analytics and measuring success in this venture allows individuals to ensure they are optimally furthering their mortgage marketing efforts.

Developing a thorough understanding of the top six facts around mortgage marketing is the first step in moving confidently toward realizing successful results. Taking advantage of the endless possibilities and technological advances in this field can open up new opportunities for marketers, ultimately helping more interested buyers make their dreams of homeownership come true.

FAQs

- What are the key facts about mortgage marketing initiatives?

The key facts about mortgage marketing initiatives include understanding customer needs, leveraging technology and social media platforms to amplify your message, crafting content specifically for target audiences, analyzing results and measuring success with data-driven decisions, and taking advantage of modern analytics tools.

- How can I ensure my mortgage marketing efforts are successful?

To ensure that your mortgage marketing efforts are successful, you should track the performance of your campaigns over time to get an overall idea of their effectiveness and analyze what worked and what didn’t.

- How to create a winning mortgage marketing plan?

A winning mortgage marketing plan should involve understanding customer needs, leveraging technology and social media platforms to amplify your message, crafting content specifically for target audiences, analyzing results and measuring success with data-driven decisions, and taking advantage of modern analytics tools.

- How to leverage technology and social media in a mortgage?

Leveraging technology and social media in mortgage marketing involves creating content specifically tailored to target audiences, optimizing campaigns for search engine visibility, utilizing data-driven decisions, and understanding customer sentiment.