In uncertain economic times, investors often seek alternative investment options to safeguard and grow their wealth. Precious metals have long been considered a reliable store of value and an effective hedge against inflation.

This comprehensive guide will explore the various aspects of investing in precious metals and provide you with the knowledge and tools necessary to make informed investment decisions.

Table of Contents

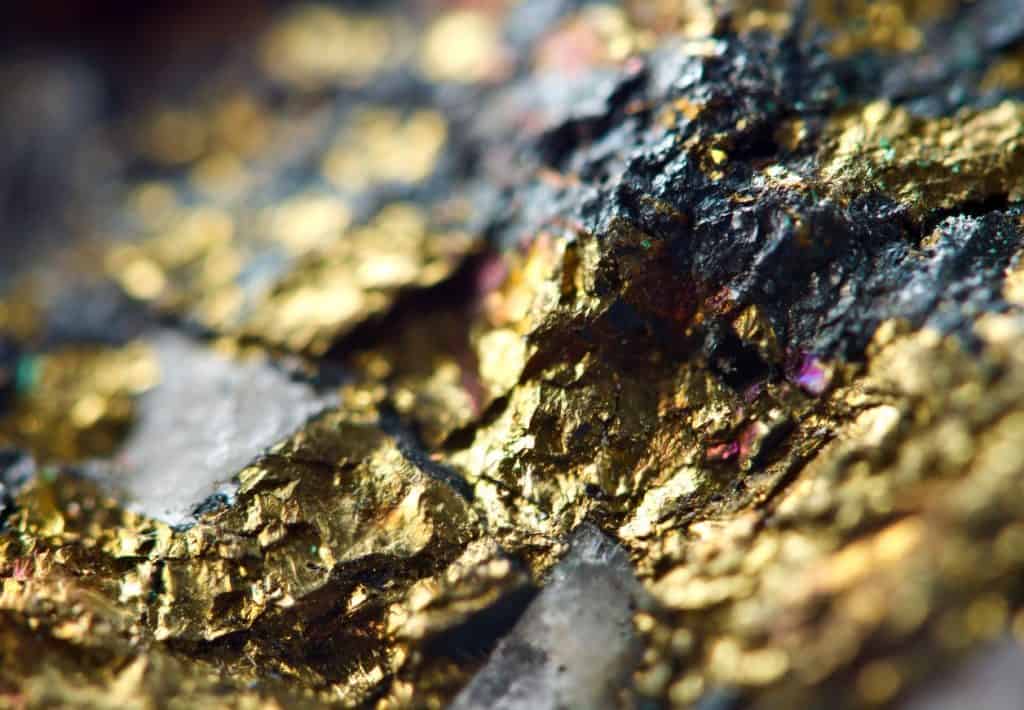

Understanding Precious Metals

Precious metals, including gold, silver, platinum, and palladium, are rare naturally occurring metallic elements.

They have been used as currency and store of value throughout human history due to their scarcity, durability, and inherent value. Investing in precious metals means buying gold or silver, which offers several advantages, including protection against inflation, diversification of investment portfolios, and potential capital appreciation.

They have historically maintained their value over time and have a low correlation with other asset classes, making them an excellent addition to any investment strategy.

Types of Precious Metal Investments

- Physical Precious Metals

Physical ownership of precious metals in the form of bars, coins, or bullion offers tangible assets that can be stored at home or in a secure vault. Investors benefit from direct ownership and can sell or trade their holdings whenever they choose.

- Exchange-Traded Funds (ETFs)

Precious metal ETFs are investment funds that own and track the price of the respective metal. They provide a convenient way to invest in precious metals like acquiring gold or silver without physical possession. ETFs offer liquidity, lower costs, and ease of trading compared to physical ownership.

- Precious Metal Mining Stocks

Investors can gain exposure to precious metals by purchasing stocks of mining companies. Mining stocks provide indirect ownership and are influenced by company management, operational costs, and geopolitical risks. They offer potential leverage to the underlying metal prices but also carry additional risks associated with the mining industry.

Factors Influencing Precious Metal Prices

The availability of precious metals from mining and recycling plays a significant role in determining their prices. Changes in demand, influenced by economic conditions, geopolitical events, and industrial applications, can create price fluctuations.

Precious metals are influenced by economic indicators such as interest rates, inflation, and currency movements. For example, during periods of economic uncertainty, investors tend to flock to safe-haven assets which is why they buy gold or other metals, driving up its price.

The monetary policies of central banks, including quantitative easing measures and interest rate adjustments, can impact the prices of precious metals. Changes in these policies often result in market volatility and affect investor sentiment.

Conducting Research and Due Diligence

Investors should analyze market trends, historical performance, and supply-demand dynamics of the precious metals they wish to invest in. Resources such as financial news, industry reports, and expert opinions can provide valuable insights.

Every investment carries inherent risks. Investors must assess risk tolerance and investment objectives before allocating funds to precious metals. Diversification, asset allocation, and understanding each investment option's potential rewards and risks are crucial.

Keeping up with market news, developments in the global economy, and geopolitical events is essential for successful precious metal investing. Regularly reviewing your investment strategy and adjusting it as necessary will help you stay ahead.

Storing and Protecting Your Investment

If you choose physical ownership, ensure a secure storage method at home, such as a safe or a dedicated storage system. Professional storage services are available for investors who prefer not to store precious metals at home.

These services offer secure vaults with advanced security measures, insurance coverage, and regular audits to ensure the safety and authenticity of your investment. Many storage providers offer easy accessibility and the option to sell or transfer your holdings when needed.

When deciding between home storage and professional storage services, consider security, convenience, insurance, and cost factors. While home storage provides immediate access to your assets, it may lack the same safety and insurance coverage as professional storage facilities.

Professional storage services offer peace of mind and are particularly suitable for large or valuable holdings.

Timing Your Investments

- Dollar-Cost Averaging

Dollar-cost averaging is a strategy where investors regularly invest a fixed amount into precious metals at predetermined intervals, regardless of the current price. This method helps mitigate the impact of short-term price fluctuations and allows for long-term accumulation at an average cost.

- Market Timing

Timing the market can be challenging, even for experienced investors. Many factors influence precious metal prices, and attempting to predict short-term price movements is speculative. Focusing on long-term investment objectives and maintaining a disciplined approach is generally advisable.

Tax Implications

Investors should know the tax implications of investing in precious metals. Depending on your jurisdiction, gains from selling precious metals may be subject to capital gains tax. Understanding the tax laws and consulting with a tax professional can help you optimize your investment strategy and minimize tax liabilities.

Exit Strategies

When selling physical precious metals, consider reputable dealers who offer fair prices and transparent transactions. It is advisable to obtain multiple quotes and compare offers before finalizing the sale.

Remember that selling physical metals may involve additional costs like assay fees or transportation expenses. On the other hand, selling ETFs or mining stocks is relatively straightforward, as they can be traded on exchanges.

It is essential to monitor market conditions and liquidity before executing a sale. Pay attention to transaction costs, such as brokerage fees, and be mindful of any tax implications resulting from the sale.

In addition to selling through reputable dealers, investors can explore online platforms such as The Alloy Market and auction websites specializing in buying and selling precious metals. These platforms provide a broader reach and potential access to a larger pool of buyers, which may result in competitive pricing.

However, it is crucial to exercise caution and verify the credibility of the platform or auction house before engaging in any transactions. When selling physical metals, monitoring market conditions and timing is advisable.

Precious metal prices can fluctuate significantly, so selling may be advantageous when prices are high or during periods of increased demand. Keeping an eye on market trends and seeking professional advice can help you make informed decisions regarding the optimal timing for selling your physical metals.

To ensure a smooth and transparent selling process, it is essential to have proper documentation and authentication for your physical metals. This includes keeping records of purchase receipts, certificates of authenticity, and any relevant documentation regarding the provenance of your metals.

Such documentation helps establish the authenticity and value of your assets when engaging with potential buyers. If you opt to sell your physical metals to a dealer or through an online platform, consider the logistics of securely transporting your assets.

Ensure that you choose a reputable shipping service specializing in handling precious metals and providing appropriate insurance coverage. Taking necessary precautions during transportation helps safeguard your investment and mitigate the risk of loss or theft.

By carefully considering these factors and taking reasonable steps, you can confidently navigate the process of selling physical precious metals and maximize your investment's value.

Final Word

Investing in precious metals can be prudent for growing and protecting your wealth. Understanding the different types of precious metal investments, conducting thorough research, and staying informed are vital components of a successful investment approach.

Whether you choose physical ownership, ETFs, or mining stocks, it is important to consider storage, timing, tax implications, and exit strategies. By employing a well-informed and disciplined investment strategy, you can leverage the unique qualities of precious metals to enhance your financial portfolio and preserve your wealth for the long term.

FAQs: How to Invest in Precious Metals: A Guide to Growing Your Wealth

- Is investing in precious metals a safe and reliable investment option?

Investing in precious metals, such as when you buy gold, silver, platinum, and palladium, has historically been considered a safe and reliable investment strategy. Precious metals have maintained their value over time and often serve as a hedge against inflation and economic uncertainties.

However, risks are involved, like any investment, and it is essential to conduct thorough research and understand market dynamics before making investment decisions.

- What are the different ways to invest in precious metals?

There are several ways to invest in precious metals. You can opt for physical ownership by purchasing bars, coins, or bullion, allowing you to own the metals directly. Another option is investing in exchange-traded funds (ETFs) that track the price of precious metals.

These provide convenience and liquidity without the need for physical possession. Additionally, you can invest in mining stocks of companies involved in extracting and producing precious metals, providing indirect exposure to the industry.

- How do I determine the right time to invest in precious metals?

Timing the market can be challenging, even for experienced investors. Various factors, including economic indicators, geopolitical events, and supply-demand dynamics, influence precious metal prices. Instead of trying to time the market, it is advisable to focus on long-term investment objectives and consider dollar-cost averaging, which involves investing a fixed amount at regular intervals.

This strategy helps mitigate the impact of short-term price fluctuations and allows for the gradual accumulation of precious metals over time.

- What factors should I consider when choosing between physical ownership and ETFs?

When deciding between physical ownership and ETFs, consider storage, security, convenience, and costs. Physical ownership provides tangible assets that you can store at home or in secure vaults, but it involves additional responsibilities for storage and insurance.

ETFs offer ease of trading, liquidity, and lower costs but do not provide physical possession. Assess your preferences, risk tolerance, and investment goals to determine which option best fits your needs.

- Are there any tax implications associated with investing in precious metals?

Tax implications can vary depending on your jurisdiction and the specific type of investment. In some cases, gains from selling precious metals may be subject to capital gains tax. It is advisable to consult with a tax professional knowledgeable about the tax laws in your country or region.

They can guide you on applicable tax obligations and help you optimize your investment strategy to minimize tax liabilities.

Remember that investing in precious metals, like any investment, involves risks, and it is essential to conduct thorough research, diversify your portfolio, and make informed decisions based on your circumstances and financial goals.