Whether you’re an employee eager to understand your earnings or an employer keen to ensure compliance and clarity in payroll, pay stubs are an essential tool. Knowing what is a pay stub is essential as they offer a snapshot of an individual’s earnings and deductions for a specific period, helping maintain transparency in the payroll process.

But what is a pay stub exactly, and what information should it include? This post is here to guide you through everything you need to know about pay stubs.

Definition Of What is a Pay Stub

A pay stub, also known as a paycheck stub or payslip, is a document issued by an employer to their employees. It provides a detailed breakdown of an employee’s earnings for a specific pay period, including gross pay, deductions, and net pay.

Pay stubs can be physical or digital documents, and while some employers still hand out paper pay stubs, many have switched to digital pay stubs for convenience and sustainability.

Platforms like https://www.thepaystubs.com/ offer digital pay stub generation services that are fast, reliable, and easy to use. These platforms are designed with the latest technology to ensure that your pay stub includes all necessary information in a user-friendly format.

Employee Information

In addition to the personal information mentioned earlier, a pay stub may also include other relevant details about the employee. One important piece of information is the employee’s job title or position within the organization. This helps in clearly identifying the role the employee holds and can be useful for reference or verification purposes.

Furthermore, pay stubs often display the employee’s unique identification number, which is assigned by the employer’s human resources or payroll system.

This number is used internally by the organization for various administrative purposes, such as tracking employee records, managing benefits, or facilitating communication with the employee.

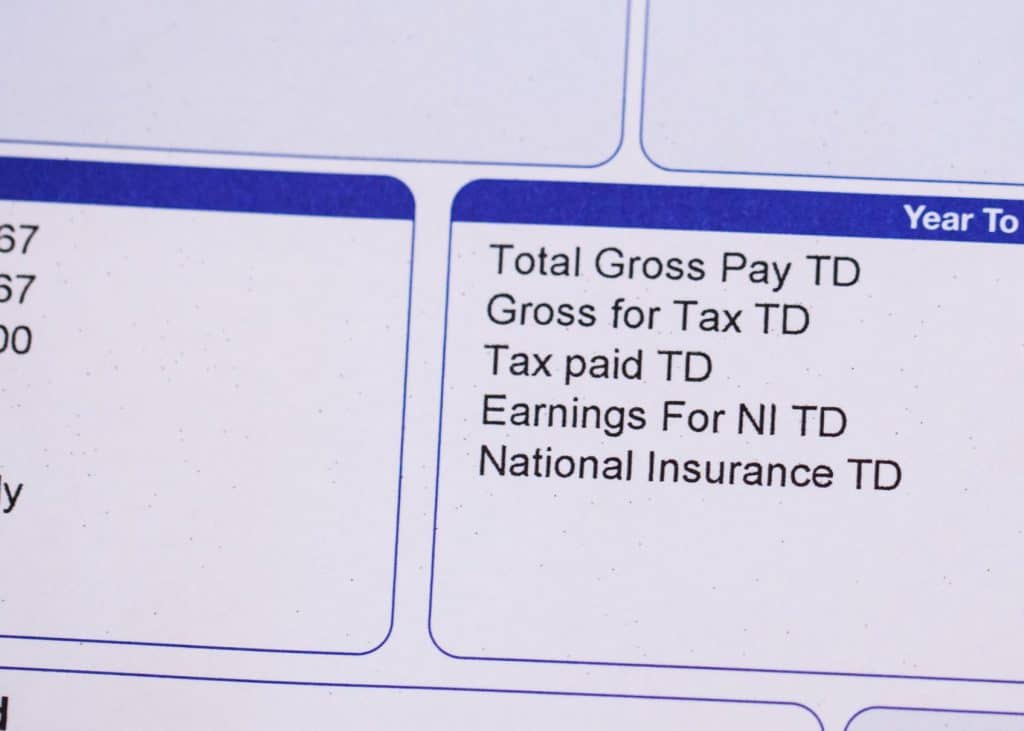

Gross Wages

Gross wages, often referred to as gross earnings, represent the total amount an employee earns before any deductions or withholdings are applied. This includes various components that contribute to the overall income of an employee during a specific pay period.

Regular wages make up a significant portion of gross wages and are typically calculated based on the employee’s regular working hours and their hourly, weekly, or monthly rate of pay. These regular wages are earned for the standard hours worked as defined by the employment agreement or company policy.

In addition to regular wages, gross wages can also include earnings from overtime hours worked. Overtime wages are typically paid at a higher rate than regular wages and are applicable when an employee works more than the standard or agreed-upon number of hours in a given workweek.

Overtime compensation is subject to specific laws and regulations that dictate the rate at which it should be paid.

Taxes

One of the essential parts of a pay stub is the tax section. This portion details federal, state, and local taxes withheld from the employee’s gross wages during the pay period.

The types of taxes withheld can vary depending on the employee’s location and other factors, but they usually include income tax, social security tax, and Medicare tax.

Deductions And Contributions

In addition to taxes, there are various other deductions and contributions that may be subtracted from an employee’s gross pay. These deductions serve different purposes and are typically outlined on the pay stub to provide transparency and ensure accurate record-keeping.

Health insurance premiums are a common deduction that employees may see on their pay stubs. These premiums represent the portion of the health insurance coverage that the employee is responsible for paying.

The amount deducted is typically based on the employee’s chosen coverage level and the premiums established by the employer or insurance provider.

Retirement plan contributions are another deduction that employees may encounter. These deductions are made towards the employee’s retirement savings, such as a 401(k) or other employer-sponsored retirement plan. The deducted amount is directed into the designated retirement account, helping employees build savings for their future.

In certain circumstances, an employee may have a garnishment on their wages. A garnishment is a court-ordered deduction that may occur when an employee has outstanding debts, such as child support, alimony, or unpaid taxes.

The garnished amount is withheld from the employee’s gross wages and paid directly to the appropriate entity as specified by the court order.

Other deductions may include contributions to employee benefits programs, such as life insurance, disability insurance, or flexible spending accounts (FSAs). These deductions are voluntary and allow employees to allocate a portion of their earnings towards specific benefits or savings accounts, providing financial protection and flexibility.

Net Pay

Finally, the pay stub should prominently display the net pay, which represents the actual amount an employee will receive after all deductions have been subtracted from their gross wages.

It is the figure that reflects the employee’s take-home pay, which can be deposited directly into their bank account if they have opted for direct deposit, or the amount they will receive if they are issued a physical paper check.

Net pay is the result of subtracting various deductions, such as taxes, health insurance premiums, retirement plan contributions, and other authorized deductions, from the gross wages.

These deductions are calculated based on the applicable tax rates, benefit plan contributions, and any other factors that affect the employee’s overall compensation.

The net pay amount is crucial for employees as it represents the actual funds they can use for personal expenses, savings, and financial planning. It is essential for employees to have a clear understanding of their net pay to effectively manage their finances and make informed decisions regarding budgeting, loan repayments, and other financial obligations.

In Conclusion

Understanding what is a pay stub isn’t just about knowing where your money is going. It’s about financial awareness, tax preparation, and ensuring accuracy in the payroll process. A comprehensive pay stub, like those generated by ThePayStubs, can provide all this information at a glance, serving as a vital tool for both employees and employers.

Remember, a pay stub is more than just a piece of paper or a digital document—it’s a record of your hard-earned money. As such, it’s crucial that it includes all necessary details clearly and accurately.