Debt often feels like a heavy burden, weighing us down both financially and mentally. With many households burdened by significant debt, it's evident that some are grappling to pay off debt and keep up with financial obligations.

Table of Contents

However, with the right strategies and mindset shifts, it is possible to pay off debt faster while still saving money. This approach enables you to regain control of your finances and strive for long-term stability and freedom.

Prioritize Your Debts – The Avalanche vs. Snowball Methods

When facing multiple debts, it's essential to prioritize which ones to pay off first. Two popular methods for doing this are the debt avalanche and debt snowball.

In the debt avalanche method, you list your debts from highest to lowest interest rate and prioritize repayment efforts on the debt with the highest rate first. This method helps you pay off debt fast by reducing total interest paid.

The debt snowball method prioritizes paying off debts from smallest balance to largest, regardless of interest rate. The motivation here is to quickly eliminate smaller debts to build momentum and stay encouraged.

Both methods have pros and cons to consider:

Avalanche Method

- Saves the most money by targeting high-interest debts first

- Best for mathematically optimal approach

- Can take longer to see initial debts paid off

Snowball Method

- Provides psychological boosts with small quick wins

- Lower priority on high-interest debts, so less optimal

- Good if you need encouragement through early wins

Ultimately, choose the method best suited for your personality and needs. Those struggling with high-interest credit card debt may benefit most from the avalanche method. However, the snowball method’s fast small wins can boost motivation.

Analyzing these two prioritization strategies is the crucial first step in any debt repayment plan. Establishing a clear system to methodically repay debts lays the groundwork for success.

Refinancing and Consolidation – Lowering Your Interest Rates

Once you’ve decided on a debt prioritization method, next explore ways to reduce interest rates. This can significantly accelerate your repayment progress. Two options to achieve this are refinancing debt or consolidation.

Refinancing involves taking out a new loan to pay off an existing one, ideally at a lower interest rate. This makes the most sense when interest rates have dropped since you took out the original loan. Refinancing is commonly used for mortgages, student loans, and auto loans.

Debt consolidation entails combining multiple high-interest debts into one consolidated loan at a lower interest rate. This simplifies repayment with just one monthly payment. A consolidation loan only makes sense if the interest rate is substantially lower than your current average rate across debts.

The key is to crunch the numbers to ensure that refinancing or consolidation provides enough interest savings to justify any associated fees. This alone can free up hundreds of dollars each month to allocate towards paying off principal debt balances faster.

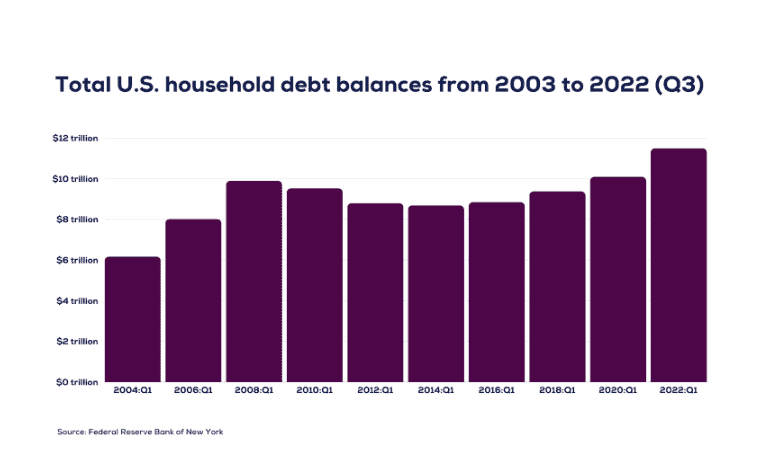

US household debt balances, 2003-2022. Overall consumer debt continues rising nationally even as individuals work to pay theirs down

Seeking Professional Guidance and Consultations

When tackling debt, it can be very helpful to seek advice and consultations from financial professionals. They can provide customized guidance to fit your unique situation. Financial advisors and credit counselors offer paid services to create personalized debt repayment plans.

They can help negotiate lower interest rates on debts and consolidate payments. For those in specific locations, local non-profit credit counseling services may be available.

For example, for residents of New York struggling with debt, the high cost of living in New York City and surrounding areas leads many households to take on significant debt. New Yorkers dealing with debt may want to consider consulting with local non-profit credit counseling services for personalized guidance.

New York residents overwhelmed by high-interest debt have the option to seek financial counseling services through New York debt relief programs. By negotiating with creditors, these debt resolution providers can secure reduced interest rates or favorable settlement offers for their clients' unsecured debts or obligations.

The goal is to help simplify New Yorkers' path to faster debt freedom relief. When researching such debt reconciliation companies, it is wise for consumers to thoroughly vet credentials, complaint records, and evidence of successfully helping clients reach financial freedom in the past.

As with signing up for any major financial service, caution should be exercised before enrolling in a debt resolution program from a private finance company or non-profit credit counselor to ensure it is a reputable fit.

Budgeting Techniques That Work

Creating and sticking to a solid budget is essential when trying to pay off debt faster while still saving. Budgeting gives you visibility into where your money is going so you can consciously control spending and allocation.

Using visual tools like a personal finance pie chart can provide an easy breakdown of how you are currently spending your income. The pie chart segments illustrate portions going towards needs like housing, debt, groceries, etc. Reviewing the pie chart allows you to identify areas where you may be overspending.

Apps can also help automate budget tracking and provide pie chart breakdowns. The key is to find a style that fits your personality. It’s also important to reassess budgets frequently and make adjustments as needed.

Earning More vs. Spending Less – A Balanced Approach

To maximize debt repayment and savings contributions, consider both increasing earnings and reducing expenses. Finding the right balance depends on your unique situation.

Increasing your income, even by a few hundred dollars a month, generates more money that can be allocated towards financial goals. Some options to earn more include:

- Finding a higher paying job in your field

- Asking for a raise after a successful project

- Taking on a side hustle like rideshare driving or freelance work

- Starting a passive income stream like affiliate marketing or online course creation

Cutting expenses too aggressively can burn you out quickly. Look for small painless cuts like:

- Negotiating lower bills and canceling unused subscriptions

- Driving a more gas efficient used car

- Eating out less and cooking at home more

- Entertaining at home instead of expensive venues

- Limiting impulse shopping and sticking to essentials

The psychological boost of paying off debt faster while still saving for the future can also improve mental health and motivation.

Leveraging Side Hustles to Increase Income for Debt Repayment

Finding ways to earn extra income in your spare time can allow you to direct significantly more money towards debt repayment goals each month. side hustles tap into your existing skills or interests to generate a second stream of cash flow.

Popular side hustle categories include:

- Rideshare driving for Uber or Lyft

- Food delivery with DoorDash or Grubhub

- Freelance services like writing, programming, design, or consulting in your field of expertise

- Selling handmade crafts or art on Etsy or at local fairs

- Monetizing a hobby like pet sitting or providing local tours

- Flipping and reselling items from thrift stores on Craigslist, eBay, or Facebook

- Renting out extra space in your home via Airbnb

Ideally, choose a side gig with flexible hours that brings in at least an extra $500 per month after taxes. This can make a major dent in chipping away at debt. Even an extra $200-300 a month makes a difference over time.

The key is balancing a side hustle with your regular job and personal obligations. Limit work to 10-15 spare hours per week. Outsourcing tasks like marketing or shipping can help maximize your hourly earnings.

Automating Savings and Payments

Manually allocating money towards different goals each month requires constant vigilance. Automating your savings and bill payments eliminates this burden.

Examples include:

- Setting up auto-transfers from checking to savings accounts

- Having portions of your paycheck direct deposited into different accounts

- Using bank bill pay features to schedule monthly payments

- Enrolling in auto-debit for bills like utilities, loans, and subscriptions

This “set it and forget it” approach ensures you always pay obligations on time while consistently contributing to savings. Any extra funds or income can then be manually directed towards debt repayment.

Automation puts your money to work quickly and efficiently without daily monitoring. Just be sure to review your finances periodically to account for any changes.

Utilizing Financial Tools and Resources

Staying organized and motivated in your debt repayment and savings journey requires helpful financial tools and resources. These can track progress, provide insight, and keep you focused on your goals.

- Budgeting apps: Mint, YNAB, Personal Capital

- Debt payoff calculators: ReadyForZero, Payoff.com

- Investing apps: Betterment, Acorns, Robinhood

- Financial Dashboards: forward Financing, loanDepot

- Free credit monitoring: Credit Karma, Experian

Beyond apps, financial advisors can provide personalized guidance for a fee. Non- profits like the National Foundation for Credit Counseling offer free financial coaching resources as well.

Leverage tools that provide the information you need most. For example, monitoring your credit score helps assess whether debt repayment efforts are improving your credit health over time.

The Impact of Lifestyle Changes on Debt Repayment

Desire alone often isn’t enough to alter financial habits long-term. Making strategic lifestyle adjustments can have a profound impact on freeing up more money to pay off debt faster.

Big Impact Lifestyle Changes:

- Downsizing to a smaller living space

- Moving to a location with lower living costs

- Trading in a car for a used one with no monthly payments

- Cutting cable TV and relying solely on free streaming alternatives

Moderate Impact Lifestyle Changes:

- Limiting meals out at restaurants

- Drinking water instead of sodas and fancy coffees

- Entertaining and vacationing for free in your local area

- Avoiding shopping unless essential items are needed

Small Impact Lifestyle Changes:

- Buying generic grocery brands instead of name brands

- Making coffee and lunches at home instead of buying out

- Turning down thermostat slightly in winter to save on utilities

- Exercising for free outdoors or with YouTube workout videos

Any lifestyle shift that saves on monthly costs can be redirected towards debt repayment and savings goals. Even minor changes add up substantially over months and years.

The key is to establish new sustainable habits. Drastic unsustainable changes often lead to burnout and reversal to old ways. Make changes thoughtfully and realistically.

Seeking Balance on Your Journey to Financial Freedom

As you implement strategies to pay off debt faster and save more, don’t forget the importance of balance for sustaining this over months or years. Paying off debt faster requires consistent effort and focus. But depriving yourself too much risks burning out.

Allow for modest indulgences in your budget occasionally. Setting aside a small “fun money” allowance each month for dining out, entertainment, or hobbies keeps life fulfilling and work rewarding during the debt repayment process.

Surrounding yourself with positive social connections also helps manage stress and maintain perspective. Loved ones often provide moral support and even creative ideas for a side hustle or budget savings.

Finally, monitor your physical and mental health. Challenging yet achievable financial goals keep you energized and motivated. But unrealistic crash dieting from expenses risks fatigue and despair. Appreciate each small win.

With balance, discipline, resilience, and hope, you can steadily walk the path to financial freedom, one empowered step at a time. The destination makes every bit of effort worthwhile.

How To Pay Off Debt – FAQ

How can I stay motivated while paying off significant debt?

Paying off debt takes consistent effort over months or years, so staying motivated is crucial. Consider setting short-term milestones and celebrating when you reach them, like paying off your smallest debt first.

Tracking your repayment progress using a tool or app can keep you motivated by letting you visualize achievements. Share your journey with trusted friends and family who can cheer you on and hold you accountable.

Should I focus on paying off debt or saving for emergencies first?

It’s a good idea to build a starter emergency fund before aggressively paying off debt. Having some cash reserves cushions you from unexpected expenses that could derail debt repayment.

Many experts suggest saving $500-1,000 before focusing on debts. Once you have a small emergency buffer, you can concentrate on paying off high-interest debt while contributing any extra funds to savings.

Can debt affect my credit score if I’m making regular payments?

Yes, your credit utilization ratio (how much you owe versus credit limits) impacts your score, even if you make on-time payments. Try to keep utilization below 30%. Paying off cards completely each month is ideal. Reducing debt balances frees up credit, lowering your utilization and improving your credit profile. In addition to making regular payments, it is essential that you monitor and understand other factors that impacts your credit score so you can make the necessary steps to help improve and maintain it.

Should I use a non-profit debt management plan or credit counseling agency?

If you're struggling with debt, these agencies can provide guidance for a monthly fee. They help negotiate lower interest rates on debts and set up managed payment plans to fit your budget. This can simplify repayment and reduce interest costs. Ensure the agency is reputable before enrolling.

Which type of debt should I focus on paying off first?

Pay off high-interest debts like credit cards first. The interest savings are typically greatest here. If you have multiple similar interest rate debts, consider paying off smaller balances first to build momentum using the debt snowball method.

Should I take a 401(k) loan or hardship withdrawal to pay off debt?

This is not recommended. You lose out on retirement savings growth and may have to pay taxes and penalties. Try cutting expenses more aggressively instead. Your retirement funds should be a last resort used only if you’re unable to reduce spending and have no other options.

Should I save anything while working to pay off debt?

Having some savings helps cope with unexpected expenses. Try to save at least 10-20% of your income alongside debt repayment. Cutting expenses can free up more money for both goals. Build an emergency fund first before focusing solely on debt pay down.

How much will paying off debt improve my credit score?

Paying down balances significantly below 30% of credit limits and eliminating debt altogether can boost your score substantially over time. The impact builds slowly at first, then accelerates after 6+ months of progress. Raising your credit limits also lowers utilization for a quick score bump.

Will a balance transfer offer help me pay off credit card debt?

It can, if you get a 0% intro APR for 12-18 months and commit to a payoff plan. Transfer high-interest balances to the new 0% card. Make payments to pay it off completely before the 0% rate expires. Don't rack up more debt on old cards. Move onto the next card once one is paid off.

What if I can only afford minimum payments on debt for now?

At a minimum, pay at least the minimums to avoid late fees and damage to your credit reports and scores. If possible, pay a little extra each month total towards your highest interest rate debts to accelerate repayment. Every dollar above the minimum goes directly towards principal. Increase payments as cash flow allows.

Final Words to Pay Off Debt

Paying down debt faster while still saving consistently requires diligence and often life adjustments. But you can regain control of your finances.

The strategies outlined above can help you systematically make progress each month, from debt prioritization, lowering interest rates, budgeting effectively, automating payments and savings, and thoughtfully altering lifestyle habits.

While the journey takes time, each small win accelerates you closer to the end goal of freedom from debt. Embrace a long-term perspective, be patient, start with small changes that build momentum. You have the power to take charge of your finances and build the stable future you desire over time.

What debt repayment and saving strategies resonate most with your current financial situation and personality? Begin putting a few into practice today. Then build on successes over time for compounding benefits. You’ve got this!